Consumer Markets are Changing Fast

Demographic changes are revolutionizing the shape of Consumer Markets around the world.

The European Consumer Market

The total European Consumer Market has peaked. In 2021 it reached 746 million. It will never return to that level again according to the latest UN Forecasts.

The biggest share of the market are the 25-64 year olds. As a market they too have peaked. They reached 411.8m in 2015 and then started to decline.

The Under 25 are the European Youth Market. They reached their maximum numbers fifty years ago in 1973. They are now 28% down from that peak. So too are the Under 15’s. They reached their maximum numbers in 1966. They are now nearly 30% down on that peak.

There is only one consumer market forecast to grow. They will grow for the next thirty years,. They are the over 65’s.

They will increase from 143m today to peak at 204m in 2056.

After that the whole market and every age group within it will decline. The UN forecasts that the whole market will be down 5% down by 2050 and 21% down by 2100. There will be 160m less consumers in Europe by then.

February 2023

The German Market is ahead of the Rest of Europe

The 26-64 Age group of consumers peaked in 1969. The Under 15's reached their highest number at the same time. The Under 25's reached their highest number only two years later in 1972. The Only growth market left are the over 65's. Even they will plateau in 10 years time.Italy and Spain are close behind.

February 2022

The Japanese Market is leading the World.

Within the next ten years all parts of the Japanese Markets will be in decline. The 26-64 Age group of consumers peaked in 1969. The Under 15's reached their highest number at the same time. The Under 25's reached their highest number only two years later in 1972. The Only growth market left are the over 65's. Even they will plateau in very soon.Italy and Spain are close behind.

Updated February 2023

Japan Shrinking by 10,000 Consumers a Week

Some countries are well ahead of any regional ageing curve. The most famous is Japan, which is an exception in Asia. After a brief post war boom, the fertility rate in Japan halved. It fell to the replacement rate as early as 1957. The fertility hovered at the replacement fertility level until around 1973. After that it sank to an all-time low of 1.26 children per female in 2005. Since then, it has risen slightly and has plateaued around 1.4.

In 2020, the annual births fell to 850,000 children. This was the lowest number since records began. Deaths were 1.4m , because of the ageing population. The Japanese market fell by half a million people in a single year. That is ten thousand consumers a week. That is equal to 5 full Boeing 787-8 planes leaving Tokyo Airport every day never to return.

April 2022

Latest data shows that the Japanese births fell to 811,000 in 2021. The best estimate for 2022 is below 800,000 births. The Japanese Office of National Statistics estimated in 2019 suggest that Japan would not reach this point until 2030. It has come 7 years too soon.

January 2023

Latest Latest Data: The 2022 number actually came out at 770,000 births. The 2024 figure has just been announced at 722,000. There were 1.6m deaths in 2024.

February 2025

Life Extends with Healthy Years

Life follows an unstoppable pattern. For all of us it is a journey we travel only once but it has a known end point. But, all the data suggests that the length of our lives is increasing. Not only that but life is extending with good years. We are blessed with an increasing period of healthy living.

Most evidence suggests that the onset of disability is being pushed backwards. According to the United Nations, this is due to early diagnosis and treatment of diseases. Better housing and improved accessibility to public buildings and transport also helps. It makes it easier for older people to live normal lives. Beyond eighty five, disability does set in. Even then recent studies show that things are not so bad. Of nonagenarians in the USA and Scandinavia almost half need little or no help to live a normal life.

The Burden of Disease

To try to measure "healthy living" the United Nations have combined data on death and diseases. They have looked at hundreds of diseases. Each is weighted by the degree to which it compromises the quality of people’s lives. From this they can calculate the “Global Burden of Disease”. For any country they compute a “healthy ageing span” and “years lived with disability”.

The results show that as life expectancy goes up the majority of those extra years are healthy years. The global picture shows that between 1990 and 2016, global life expectancy went up by 7.4 years. 85% of the added years were “good” years. The figures for most countries are the same. Life expectancy in the UK went up by just over five years. Nearly ninety percent of them were “healthy ageing” years. China had a huge 12.4 year increase in life expectancy. Eight years of that was without disability.

October 2021

Living Healthier

Living Healthier Longer

The General Household Survey of the UK Government is a regular measure of opinions and lifestyles. Amongst these are self-assessments of general health and “limiting long term illness”. The latter is a subjective measure of when poor health interferes with living a normal life.

In the past 20 years the changes in this measure have been profound. Let us look at those changes.

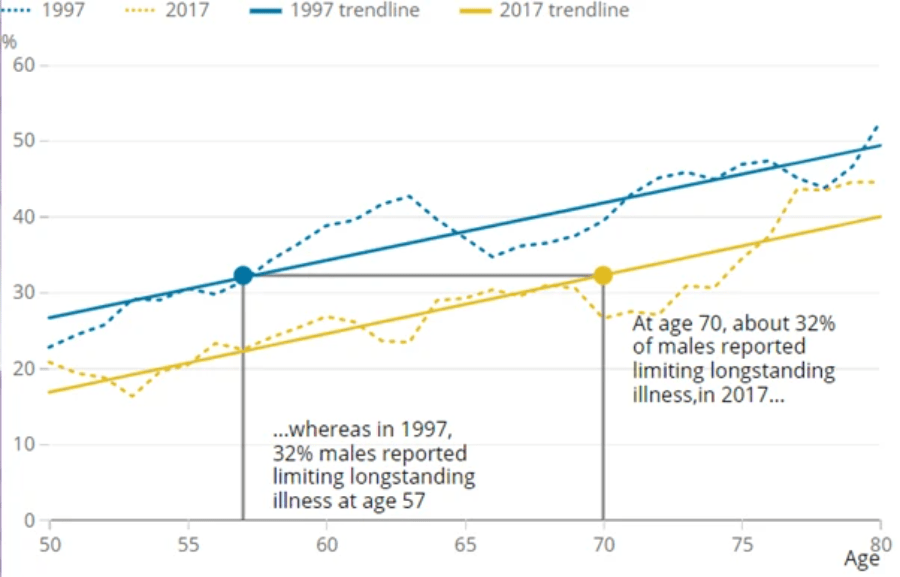

Men having "limiting long standing illness" in 1997 and 2017

Data from the UK General Household Survey .

This is a complex chart. Let’s start with the blue line which is the data from 1997. The blue dots are the actual responses. For example look at the data for the 70 year olds. 40% said they suffered from illnesses sufficiently severe to inhibit their normal day to day activity. The solid blue smooths the dots with a trend line. As expected as age increases the percentage with “limiting long term illness" goes up. Even in 1997 only half of the people surveyed who were eighty had such a health problem. The rest were able to consume as normal.

The yellow lines represents the results from the identical government survey taken twenty years later. The line has moved downwards. The trend lines are roughly parallel but the yellow line is lower. Now 60% of the eighty year olds, rather than 50% in 1997, are fit and active.

The changes are huge in twenty years. In 2017, our seventy-year-old man had a thirty two percent chance of feeling that his health was limiting his lifestyle as a consumer. To get the same thirty two percent on the 1997 curve would make that man only fifty-seven years old. In only twenty years the onset of such a health condition has pushed back thirteen years.

That is a phenomenal rate of change and has huge implications for the size of the “healthy ageing” market. The number of UK people over sixty-five increased in those twenty years by 38% . There has been a multiplier effect on the size of the "market". The proportion of them healthy enough to maintain their lifestyle, as consumers, has increased as well. The result is that the number of "healthy ageing" people has increased fifty nine percent.

October 2021

Germany is twenty to thirty years ahead of countries like the UK in Market Evolution

It is a good example of the changes that marketers will face all over the world in the future as markets change. The changes in the population represents the largest evolution of the consumer market since modern marketing was invented. Until the turn of the last century all service businesses were generating half of their growth from an increasing number of consumers. The balance came from increased consumption per head. Marketers in Germany can no longer count on more customers. In the period 2015-2030 McKinsey estimate that three quarters of any market growth in Western Europe will have to come from increased consumption per head (McKinsey Global Institute, 2016).

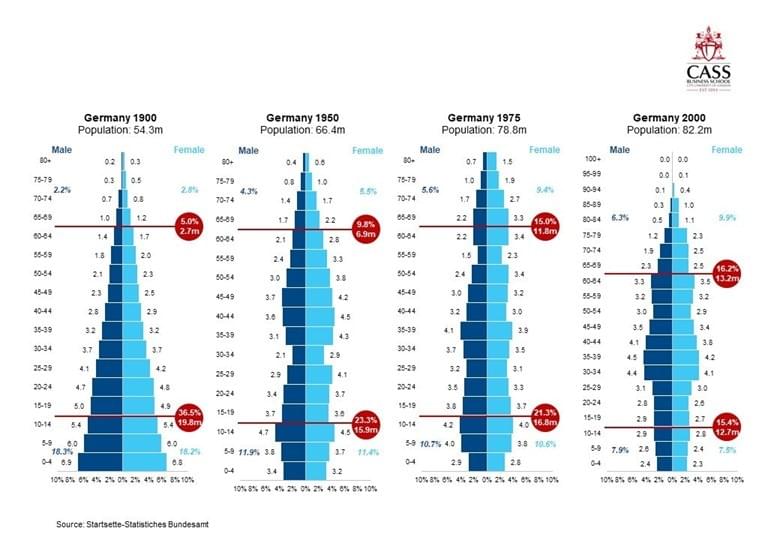

The German “post retirement” market will double between 2000 and 2050. It rises from 13.2 million in 2000 to 24.1 million in 2040. It will then plateau. For reference it was only 2.7 million in 1900. This is a fast-growing and attractive market with a narrow window of opportunity. By comparison, all other age groups are declining in size.

Within these dramatic changes we must even look at the split within the “post retirement” market. In 1900 there were just over 100,000 Germans aged eighty or over. This rose to 2.9 million in 2000. It will jump to 10.7 million by 2050, in only thirty years’ time. There will be more Germans over 80 market than under 15.

More Grandparents than Grandchildren

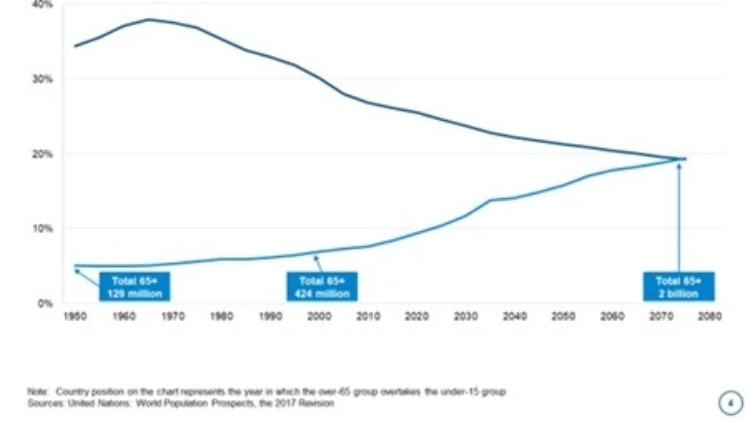

The point where there are more "grandparents than grandchildren" is a good index. This is the point at which the over 65’s are a bigger percentage of the population than the under 15’s. It represents a shift in favour of the over 65’s in the consumer market dynamics.

A few European countries reached the cross over point before the year 2000. Germany was amongst them. Japan also passed that point in the last century. From this small start only 20 years ago, the spread of the changes accelerates dramatically.

Europe, as a continent, made the transition 15 years ago. A European born in 1950, was born into a world where the young were 26 percent of the population and the old only 8 percent. By 2020 that person will be seventy. Europe will have nearly 19 percent of its market “sixty-five and over”. It will have only 17 percent under fifteen. The European population will have grown. From 549 million to 744 million. The “sixty-five and older” market will have grown from 44 million to 140 million. This, in a single lifetime of seventy short years.

This decade sees massive shifts in the over 65 markets. Russia, the USA, and China will all pass the cross over point by the end of the decade. At any moment North America will reach the tipping point. There will then be only five years before Oceania and Asia complete the transition to having more over 65's than under 15's. Remember that Asia is by far and away the largest continent in terms of people. Alone it represents 63 percent of the global population today. China, with a population of 1.4BN is on the point of crossing over and in many cities they already have. Last comes Africa.

Even within individual continents there is a broad spread of tipping points across countries. Some countries are well ahead of any regional ageing curve. The most famous is Japan, which is an exception in Asia.

April 2021

The Global Old/Young Split is Changing

The darker line is the percentage over 65 and the lighter “Under 15”. It shows that around 2075 the old will dominate the global market. The chart also shows the sheer huge number of older people. This grows for 129 million in 1950 to close to two billion by 2075 only 150 years later.Evolution of the German Population 1900-2000

You’ve read all your free member-only stories.

Become a member to get unlimited access and support the voices you want to hear more from.

The Evolution of the German Population : A Case History

The speed and scale of what is happening to the shape of populations around the world is difficult to comprehend. It is simpler to start with a single country. The figure below shows a series of “population pyramids” over the last 100 years for Germany. Such a “pyramid” is the standard tool used by demographers to describe a country’s population. Each step in the pyramid represents an age band and shows the percentage of the population in that band for men and women separately.

In 1900, Germany had a population of only just under fifty-four million people. It is easy to understand why they are called pyramids. Nearly fourteen percent of the population was under five. Over thirty six percent were children under fifteen and only five percent were over sixty-five. There were many more grandchildren than grandparents.

In 1900 infant mortality, that is the number of babies that died before their first birthday, was nearly twenty two percent. However, even this does not completely explain the shape of the population pyramid. Child mortality, death before the age of five, was just under thirty percent. This explains the wide base to the pyramid that becomes thinner quickly, nearly one third of children died before their fifth birthday.

Germany changed significantly in the next fifty years. The population pyramid has started to look much more like a column. Fortunately, child mortality had dropped dramatically to just under six percent in 1950. A lot more children were living to adulthood. At the same time fertility had plummeted. In 1950 women were averaging less than one and a half children. This is far below the rate at which the population is just maintained. This is known as the replacement rate which, at that time, was estimated to be two and a half children per female. The share of the population under fifteen has dropped to just under a quarter and those sixty-five and over had risen to just under ten percent. The population itself had grown to seventy million people. The “pyramid” is hardly recognizable.

By 2000 the evolution of the age profile of the German population was continuing and the “pyramid” resembles more and more a “column”. Medical science had increasingly focused on the elderly rather than the young. Life expectancy has grown. The “grandparents” have passed “the grandchildren” for the first time in the history .

After a century of advances in medicine, nutrition and public heath, the child mortality rate had dropped to close to half a percent. Fertility was still hovering around a plateau of one and a half. Germany has become the second oldest country in the world after Japan. Even if fertility were to rise it would take many years to change the shape of the pyramid.

April 2021

The Power of the Cities

Urbanization is one of the four demographic megatrends according to the United Nations. The others are population growth, population ageing and international migration. Urbanization is an unstoppable force. People all over the world migrate to the cities to improve their economic prospects.

Urbanization and the ageing of the population have gone hand in hand. In the nineteen fifties, most regions had urbanization levels below thirty percent. The exceptions, not unexpectedly, were regions such as North America and Western Europe. Since then, urbanization has accelerated all over the world. Only sub-Saharan Africa and North Eastern Asia now lag.

Cities grow because they accumulate people. They are attracted by the opportunities to improve their income. The also come for the opportunity to spend it. Roughly sixty percent of city growth comes from increased population. The remaining forty percent from increased GDP per head. Retail and service development takes place first in the cities.

The McKinsey Institute argue that cities are the growth engines of the global consumer economy. Consumption is extra-ordinarily concentrated in the major cities. People living in large cities will account for fifty percent of the global population by 2030. They will however generate eighty one percent of global consumption. Ninety seven percent of the world’s population growth from 2015 to 2030 will occur in cities. In the next ten years, the cities will be responsible for a massive ninety one percent of global consumption growth.

Cities and the Ageing Market

There are cities in America that are older than Japan. Cities within a country can have different age profiles. They can be at different stages in the development of the over 65 consumer market. The averages hide all this. China may be late in the ageing race, but Fushun has a median age already of forty-five , as old as any city in the world. There are ten years difference in the median age of Naples and Trieste, both within Italy.

Despite the relentlessness of urbanization, some cities already have a declining population. Places such as Seoul, Athens, Detroit, and Havana have a declining birth rate. They also have high levels of migration. The cities are ageing and even declining. The proportion of older consumers must be increasing. The sixty-five and above age group is growing faster than the cities themselves. Punta Gorda in Florida is forecast to soon have fifty seven percent of its population over the age of sixty. Orense in Spain will be at forty seven percent as will Imabari in Japan within ten years. US sunbelt “retirement” cities feature high on the list. They are joined by Gera in Germany, Seogwipo in South Korea, and Trieste in Italy.

Today cities in Europe and Japan have the highest share of the over sixty fives. The North American cities will quickly catch up. By 2030 Tokyo will have thirteen point two million consumers over 60. New York by then will rank third in the world after Tokyo and Osaka for over 65 residents . Number four in the rankings will be the Rhine-Ruhr region of Germany. London remains a young city with only 3.8m over 65s. These are mega-markets. They rank ahead of many countries in number of older people and their spending power. These are where the power of the over 65 consumers will be felt.

This is not just about increasing shares of older people. These, and many other cities, are losing young people. The over 65’s in these cities have the spending power. More and more cities around the world will join the list. Shanghai, Beijing, Mumbai, Sao Paulo, Tianjin and Chongqing will soon join the top twenty Third Age Markets.

Chinese Cities will Decline

The growth of prosperity in China has led to a massive urbanization of the population. An estimated sixty percent now live in the cities. Around the world growth is extra-ordinarily concentrated in the major cities. By 2030, people living in large cities will account for fifty percent of the global population. They will however account for eighty one percent of global consumption. The cities will generate a massive ninety one percent of global consumption growth until 2030. Of the top thirty city “growth engines” twelve are in China.

Despite this, demographics are unstoppable. It is forecast that ninety percent of Chinese cities will have a decline in their fifteen- to twenty-nine-year-olds. Across all Chinese cities this age group will decline by twenty percent. By 2030, Beijing and Shanghai will rank number two and three in the world for the most people over sixty-five. (These over sixty fives only include those with a spending power of more than twenty thousand dollars). Fushan now has a median age of 45, making it one of the oldest cities in the world.

Tokyo would rank in the top fifteen on spending power if it were a country

Just thirty-two cities globally will then generate one quarter of total urban consumption. One hundred cities will account for nearly half of all consumption growth.

h according to the McKinsey Institute. The greater metropolitan area of Tokyo is the largest mega-city. In 2020 it had a population of over 37 million people. If Tokyo were a country it would rank in the top fifteen countries in the world on spending power. It would be comparable in size to Spain. It ranks number one in the world and looks to remain so for some time.Of those thirty-two city growth engines twelve are in China and eleven in the USA. McKinsey estimates London will be the fastest growing city in terms of spending power. They estimate ( pre-COVID) it will grow by three hundred and sixty-seven billion dollars by 2030.

Changing Household Composition

There are an increasing number of empty homes in Japan.. They are homes that have been abandoned due to the death of their owners. Their heirs refuse to manage the homes and instead abandon them. This is a non-trivial problem. Current estimates suggest that there are 8.5m empty homes in Japan. This is 14% of the total housing stock. Nomura the investment bank suggests a worst case scenario of 22m homes by 2038 as populations fall. This would be 31% of the total stock, nearly one in three.

This is not concentrated in one specific area. Even in Tokyo it is estimated that one in ten houses are empty, according to the Government Survey of Land and Housing. Residential streets will often be blighted by an occasional derelict home. The housing stock now easily exceeds any likely future demand, so fast in the population declining.

It is bad in the dormitory towns that sprang up around Tokyo in the boom days of the 1960’s and 1970’s. In these areas there are many more empty houses and the population that remains is aging fast. The situation is worst of all in the rural areas. By 2040, some 900 towns will no longer exist.

In 1960 only 16.5% of households were single person. That more than doubled to over 38% in 2020. Half of the single person households are people with a job. The other half, or roughly 18% of all households today, are pensioners living alone. Young people entering the job market and retirees tend increasingly to live alone. The biggest group of men living alone are between the age of 25 and 34. These are the ones entering the job market. Only 20% of young women live alone. But over half of all women living alone are over 75. These are the retirees.

The Japanese model was always of multi-generational families living together. A couple would take care of their parents and their children. The burden could be shared with siblings. The collapse in fertility means less people have a brother of sister to share the care of their parents. The resultant pressure has led to a collapse in such arrangements by a half. This is good news for makers of domestic appliance such as Panasonic. The number of households is increasing. Many of the new households are being formed by people over 65. They will need fridges and vacuum cleaners.

May 2022